What is fraud?

‘Any person who with a view to securing an unlawful gain for himself or another wilfully induces an erroneous belief in another person by false pretences or concealment of the truth, or wilfully reinforces an erroneous belief, and thus causes that person to act to the prejudice of his or another’s financial interests, is liable to a custodial sentence […].’ (Art. 146(1) of the Swiss Criminal Code)

This definition of fraud comprises elements of criminal activity and presumes malice, unjust enrichment and deceit. However, the umbrella term of ‘fraud’ also covers other unlawful acts that fall under the definition of ‘corporate crime’.

Corporate crime, and in particular corporate fraud, relates to acts that constitute intentional wrongdoing, toleration or omission in the name of a company for the purpose of personal enrichment. The range of corporate crime extends from minor offences (e.g. reporting sick although the person is not ill) all the way through to very complex offences whose impact goes beyond harming individual economic interests and therefore entail significant losses and/or losses affecting many companies or individuals. Kroll’s ‘Global Fraud and Risk Report 2019/20’ shows that external and internal fraud continues to play a key role for the global financial services industry to this day. According to the Kroll survey, 35% of incidents that impacted financial services organisations in 2019 related to external fraud, while 25% related to internal fraud.

How does somebody become a fraudster?

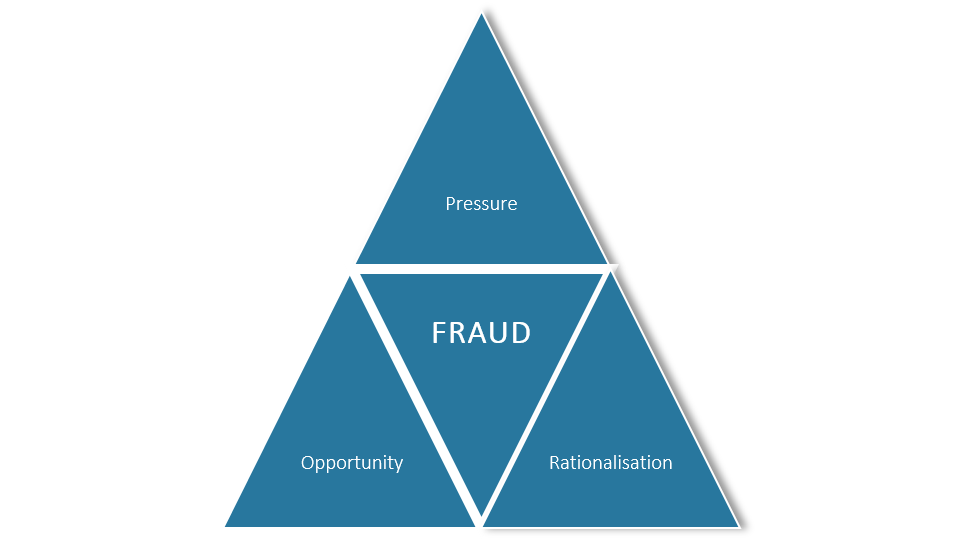

Why do people commit fraud? Donald R. Cressey’s fraud triangle gives us a clue to the answer to this question.

This triangle contains three elements that increase the risk of committing fraud:

- Pressure: A subjectively pursued incentive or subjectively perceived pressure

- Opportunity: A subjectively perceived opportunity and the ability to perform a fraudulent act

- Rationalisation: Rationalisation of the fraudulent act

The goal is to ensure that fraudulent acts don’t happen in the first place and hence prevent them – or, in metaphorical terms, to break through at least one of the three sides of the triangle. A particularly effective solution is to break through the ‘Opportunity’ side and take measures to prevent the act from being successful.

How exactly can fraudulent acts be prevented?

The following three measures can and must be taken by financial services providers within the meaning of the AMLA to prevent or detect fraudulent acts:

- Prevention: Appropriate measures such as a well-integrated governance structure, early identification of vulnerable employees, rulebooks and internal controls that can prevent fraudulent acts. More on this in part 2 of this series.

- Detection: Definition of measures and actions that reveal fraudulent acts within the company or its sphere of influence. More on this in part 3 of this series.

- Clarification: Preparation of analyses of fraudulent activity that has occurred so as to ascertain the losses and identify and examine affected business areas.

In part 2, you will learn whether Prometheus can protect his Aletheia.